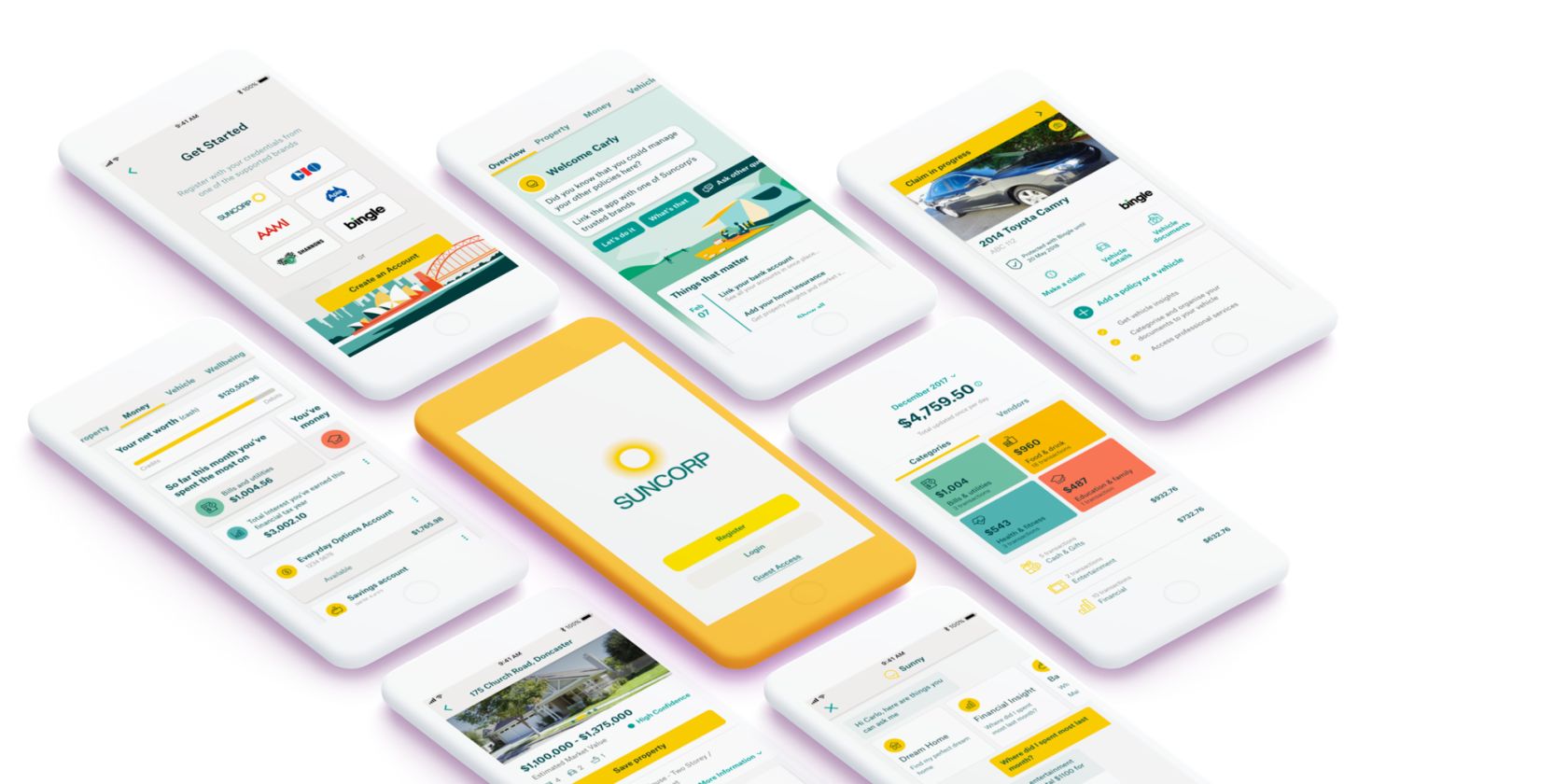

Australian consumers ditching their wallets for their phones

Australians are increasingly using their smartphones to make payments and manage their finances.

Share

As Suncorp marks the one-year anniversary of the Suncorp App, research has found 45 per cent of Australian consumers are using their smartphones to manage their banking needs.

Suncorp Executive General Manager Customer & Digital, Rachna Gandhi said Australian consumers are using their smartphones to not only make cashless purchases, but to manage all aspects of their finances.

“Phones are fast becoming the new wallet for Australians, as more merchants accept cashless payments and customers choose convenience over carrying cash,” said Dr Rachna Gandhi.

“Australian consumers are increasingly using their smartphones and tablets for everyday financial activity – checking account balances, paying bills, changing details and applying for new products.

Customers want on-the-go digital solutions that save time and money, and solutions such as our Suncorp App are meeting that need.

Rachna Gandhi, Executive General Manager Customer & Digital, Suncorp

“Over the last year we’ve given customers Apple Pay integration, real-time payments to other accounts, and access to Insurance and Claims related payments and updates,” Dr Rachna Gandhi said.

Customers have spent more than $58 million through Suncorp rewards, saving more than 23,000 transacting customers over $3.2 million. The Suncorp App’s property pillar is also in the three top three frequently used features.

Dr Rachna Gandhi said that the Suncorp App would continue to add new features to keep pace with consumers’ demand to manage their money digitally.

Suncorp’s App was the winner of Best Innovation in Customer Experience at this year’s RFI Banking Awards, beating CBA, ING, Westpac and CUA as category finalists.

In the latest release, future-dated and recurring payments have been made easier, a Rewards wallet means customers can easily view their e-Purchases and vouchers, and Insurance customers can go green with direct Electronic Notice Delivery (END).

Notes: Industry data from RFI Group Research – Digital Banking behaviours (Australian Savings & Deposits Council)