Suncorp half year 2022 result announcement

Suncorp Group’s results for the six months to 31 December 2021 demonstrate strong underlying business momentum despite higher claims costs from natural hazards and lower investment market returns.

Share

#Key points

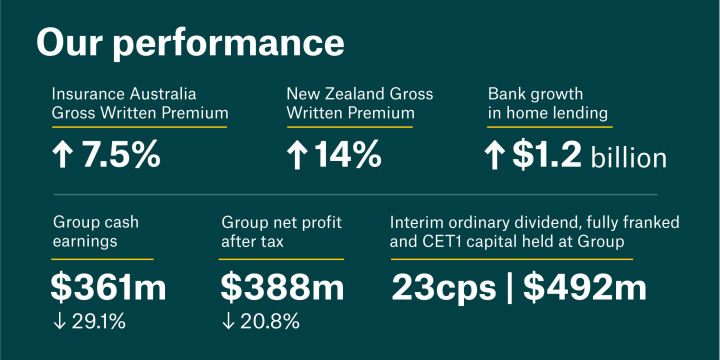

- Group net profit after tax was down 20.8% to $388 million and cash earnings of $361 million decreased by 29.1% as the Group responded to 19 separate weather events and more than 50,000 natural hazard claims during the half.

This resulted in natural hazard claims costs of $695 million — $205 million more than expected for the first half of the financial year.

The strong underlying business momentum and the protection provided by the Group’s reinsurance program allowed the Board to determine a fully franked interim ordinary dividend of 23 cents per share to shareholders — at the top end of the 60% to 80% payout range.

Insurance Australia Gross Written Premium (GWP) grew 7.5% (excluding portfolio exits), driven by a continued focus on revitalising growth, including the launch of new product features and continued refinement of digital customer experiences.

Profit in the Bank increased to $200 million and accounted for 55% of Group cash earnings for the half, demonstrating the benefit of having diversified sources of profit.

Bank home lending grew by 2.7% in the half (5.3% annualised). This reflects credit assessment efficiency, consistent competitive offerings and improved customer and broker experiences. Customer deposits grew by 7.8% over the half to $44.8 billion, driven by at-call transaction accounts. NIM decreased 12 bps from 2H21 to 1.97%.

New Zealand GWP grew 14.0%, with strong growth across all consumer and commercial lines. This top-line growth was partly offset by higher natural hazard costs, working claims and lower investment returns.

The net impact of investment markets on the result was $61 million. This was down significantly with volatility across yields, breakeven inflation, credit spreads and equity markets across the year.

The Group's underlying ITR increased to 8.0% (excluding COVID-19 impacts) in 1H22, which represents strong progress towards the target of 10–12% in FY23.

Group operating expenses were $1.4 billion, up $42 million on pcp, largely due to the temporary increase on spending on strategic initiatives, and higher growth-related costs with increased commissions and marketing.

#Group CEO commentary

Suncorp Group CEO Steve Johnston said: “While we have been challenged by the La Niña climate pattern and the operational impacts of COVID-19, we continue to deliver against our strategic priorities and have good momentum as we move into the second half of FY22.

“I am particularly proud of how we have supported our customers and communities during this time. Despite the many challenges of COVID-19 our teams have mobilised quickly to get our customers back on their feet.

"GWP growth in Australia and New Zealand is a standout, and the Group's underlying ITR increase to 8.0% shows we are delivering.

"Across all three businesses we are growing, becoming more efficient and improving how we serve our customers.

"This year will be critical for the Group as we continue to deliver on our FY23 plan and strategic initiatives. We have momentum across our three businesses and our focus is on continued execution to ensure we hit our targets.

"The work we have done over the last couple of years — digitising, rejuvenating brands, investing in underwriting systems and best in class claims — is starting to pay off and is behind the improvements in the business’ underlying strength. Fundamentals are strong and we are in a good position to continue momentum through the second half.”