Suncorp Bank unveils new bank account with carbon insights

Your morning coffee just got more intel: Suncorp Bank gives customers the knowledge to make a change.

Share

Suncorp Bank is Australia's first financial institution with carbon neutral personal deposit transaction accounts including a new account with carbon insights.

Do you know the amount of carbon emitted to make your cup of coffee this morning?

… Not sure?

Don’t worry, you’re not alone!

Suncorp Bank’s latest research[i] revealed 95 percent of Australians don’t know they generate carbon emissions or understand the impact of their carbon footprint.

The good news is three in four Aussies want to do something about it.

[i] Suncorp Bank’s Cost of the Future Report aims to understand Australian’s biggest worries, concerns, and priorities for the future. It explores the economic and environmental issues of Australians, the role people have in building and protecting their world, and the legacy they want to leave. The research surveyed a nationally representative sample of more than 1000 Australians aged 18+. It was conducted by research company, Kantar in July 2022 on behalf of Suncorp Bank.

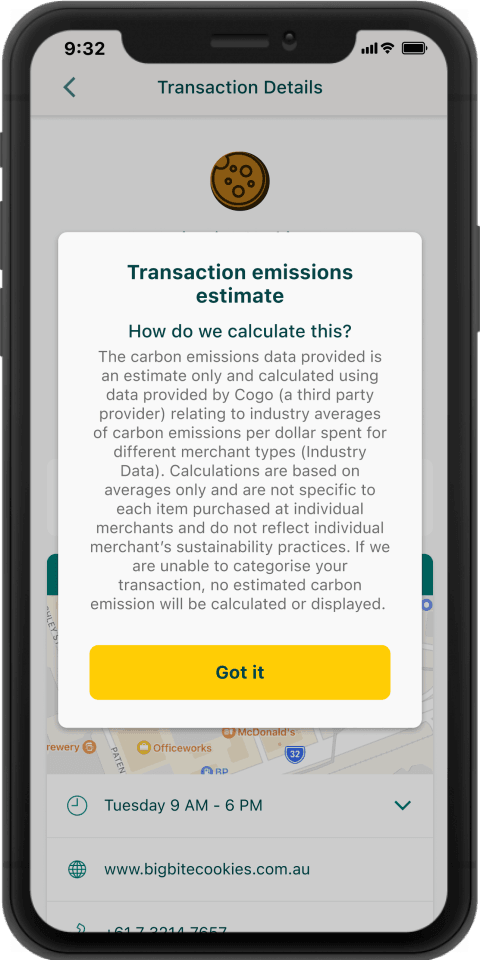

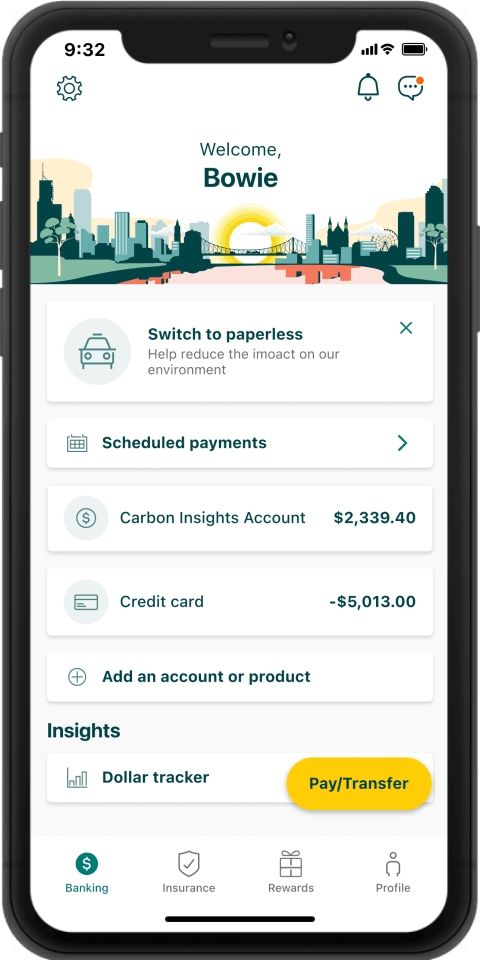

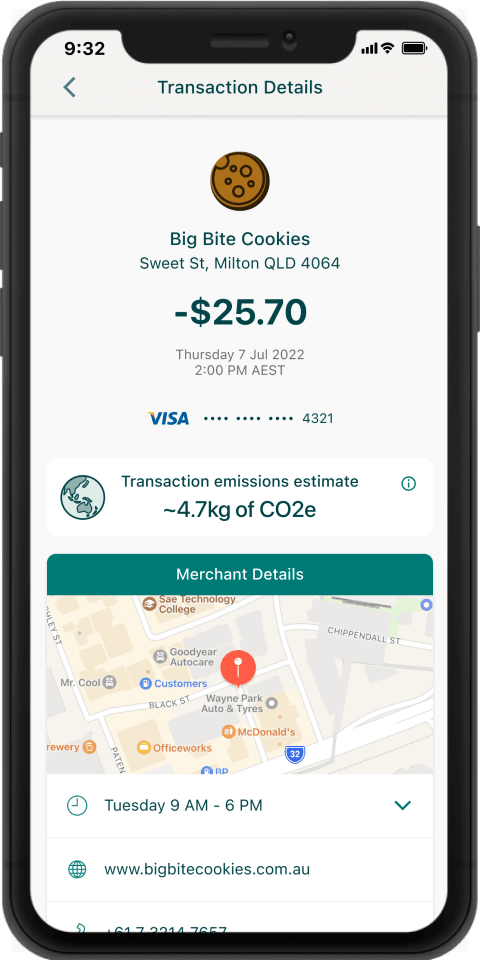

Introducing Suncorp Bank’s new Carbon Insights Account[i]. It’s a carbon-neutral, fee free, online transaction account that lets customers view their estimated carbon emissions, based on the purchases they make using the account in the Suncorp App[ii]. The estimate is calculated by multiplying the amount spent by the average carbon emissions produced by that industry.

That’s putting the power of knowledge in your hands.

If you drove your car, charged your phone or bought a coffee today, chances are those choices influenced your carbon footprint. It’s the same for most of our spending, and with the Carbon Insights Account, we can start to make more thoughtful decisions about how we buy and what we spend.

Suncorp Bank CEO, Clive van Horen

“Suncorp Bank is working hard to create a brighter future for our customers’ world and for the world. We are all learning how to achieve a more sustainable future and we want to make it easier for our customers who share this dream.”

“This is why we have become the first Australian financial institution to be certified carbon neutral for both our operations and personal deposit transaction accounts[i]. It means customers can bank with us knowing that we are not only carbon neutral as an organisation, but so are our personal deposit transaction accounts which include the Carbon Insights Account. This Australian first is an achievement we’re proud of, but it’s only one step towards our goal to support a more sustainable future”.

“We are committed to partnering with customers who care about sustainability, to create a brighter future. The Carbon Insights Account provides customers with information to help them on this journey,” Mr. van Horen said.

Available to new and existing customers via the Suncorp App, the Carbon Insights Account has been developed in partnership with carbon footprint management fintech Cogo.

This is just the beginning. Next year, more features will be added to our Carbon Insights Account, including a customer’s estimated carbon emissions broken down into spend categories and personalised suggestions around how they can manage their carbon footprint

Suncorp Bank CEO, Clive van Horen

Mr. van Horen said: “The time for financial institutions to harness the power of collective action is now. Suncorp Bank should be applauded for actively investing in promoting technology that will help Australia transition to a lower carbon economy by helping everyday Australians to manage their carbon footprint,” said Cogo’s CEO for APAC, Julie Lindenberg.

“Australia has a significant population, creating the ideal environment for a climate action solution like Cogo’s. We’re proud to be the go-to solution for change for the world’s largest banks and financial institutions, and we’re excited about having a positive impact on climate change in partnership with Suncorp Bank,” Ms. Lindenberg continued.

Now that is banking you can feel good about!

[1] Suncorp Bank’s Cost of the Future Report aims to understand Australian’s biggest worries, concerns, and priorities for the future. It explores the economic and environmental issues of Australians, the role people have in building and protecting their world, and the legacy they want to leave. The research surveyed a nationally representative sample of more than 1000 Australians aged 18+. It was conducted by research company, Kantar in July 2022 on behalf of Suncorp Bank.

[1] Carbon Insights Account issued by Suncorp-Metway Limited (Suncorp Bank) ABN 66 010 831 722.

[1] Suncorp Bank’s personal transaction accounts have been certified as Australia’s first carbon neutral bank accounts by Climate Active.

- Suncorp Bank’s carbon neutral certification has been achieved by purchasing 17,987 Australian Carbon Credit Units (ACCUs) or carbon offsets from projects that remove greenhouse gas emissions from the atmosphere.

- We have also saved on greenhouse gas emissions through switching to renewable energy providers like Diamond Energy, decommissioning old equipment and switching our fleet of vehicles to hybrid and electric only.

- We have invested in carbon projects that help regenerate Australia’s ecosystem and improve biodiversity in the wake of land clearing and other loss, like bushfires and floods.

About Cogo

Cogo is a carbon footprint management product that helps individuals and businesses to measure, reduce and offset their impact on the climate. Cogo does this through partnerships with some of the world's largest banks to integrate leading carbon-tracking functionality into their banking apps via open-banking technology. Cogo uses best-in-class models to provide accurate ways to measure carbon emissions specific to local markets and cutting edge behavioural science techniques to nudge customers to make more sustainable choices. Cogo currently works with seven of the world's largest banks and currently helps over a million customers around the world track their carbon footprint. Originally founded in New Zealand in 2016, Cogo now employs over 100 people and operates in 12 countries across Europe and Asia-Pacific, including, UK, New Zealand, Australia, Japan, and Singapore. Cogo has raised over US$10million in funding since launch. To find out more information about Cogo, please visit cogo.co.